“We are not yet seeing large-scale fragmentation, but there are initial signs,” said World Trade Organization chief Ngozi Okonjo-Iweala. This trend is, firstly, dangerous and, secondly, could ultimately prove to be “very costly”. “Let’s rethink globalization.” WTO chief warns of “dangerous” fragmentation of world trade.

Source: Der Spiegel

A brief investigative commentary

Reshoring, also known as ‘onshoring’, involves the returning of production and manufacturing of goods to the company’s original country. It can help strengthen an economy by creating manufacturing jobs and reducing unemployment.[1]

Offshoring, on the other hand, can be framed as the relocation of value chain activities from a firm’s country of origin to foreign locations as outsourcing and investing, and has often been associated with strategies pursuing cost savings, and increased revenues.[2] It is the opposite of reshoring where companies bring production and manufacturing back to the country in which it was first established.[3]

In today’s uncertain world, reshoring is often depicted as the successor to offshoring. However, recently, a new term has emerged – ‘friendshoring’ which refers to the rerouting of supply chains to countries perceived as politically and economically safe or low-risk, to avoid disruption to the flow of business.[4]

As countries around the world, especially in Asia, continue to develop, labor costs are increasing and shipping costs are becoming prohibitive. For some businesses, the cost difference between operating onshore or offshore is negligible, and thus the gap is growing smaller. However, one of the main disadvantages of offshoring reverting to reshoring is the huge costs involved in moving manufacturing operations from one country to another.

Moreover, considering the instability of international trade – the geopolitical situation has changed dramatically over the past decade, with China showing signs of taking a leading role in trading internationally. Meanwhile, with the US taking a more cautious position and other changes that have happened in global trade relations (such as Brexit), having overseas operations represents a much higher risk today.[5]

In the UK, following Brexit and Covid-19, the focus of reshoring is moving back to its own shores in attempts to strengthen its manufacturing resilience and to ensure its supply chains in a fragmented world.[6]

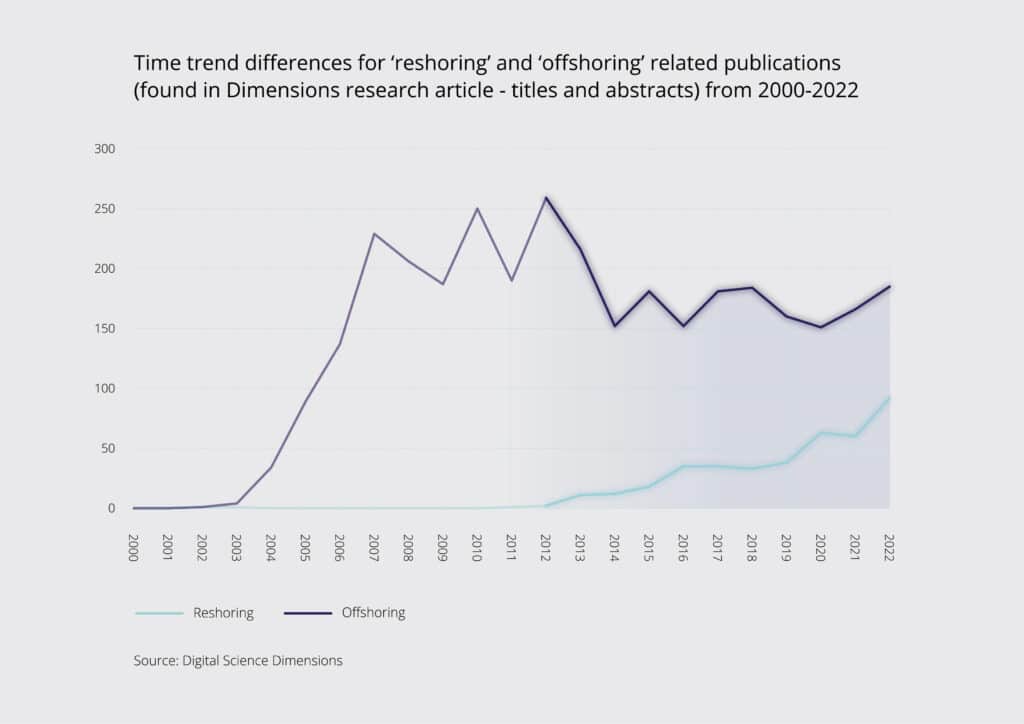

“…the number of research publications associated with offshoring vastly outweighs that of reshoring. However, what is of more interest is looking at trends over time.”

The empirical evidence on reshoring in the last decade highlights that reshoring processes are on the rise, with larger firms and medium to high-tech industries exhibiting the greatest reshoring propensity.[7]

Using data in Dimensions, we take a brief look to see what trends are evident. Is reshoring (fragmentation) on the rise at the expense of offshoring (globalization)? Globalization is used here as a proxy for offshoring and fragmentation is used as a proxy for reshoring.

We created two simple keyword searches in Dimensions, the first, ‘reshoring’ and the second, ‘offshoring’. The data produced by Dimensions reveals that overall the number of research publications associated with offshoring vastly outweighs that of reshoring. However, what is of more interest is looking at trends over time.

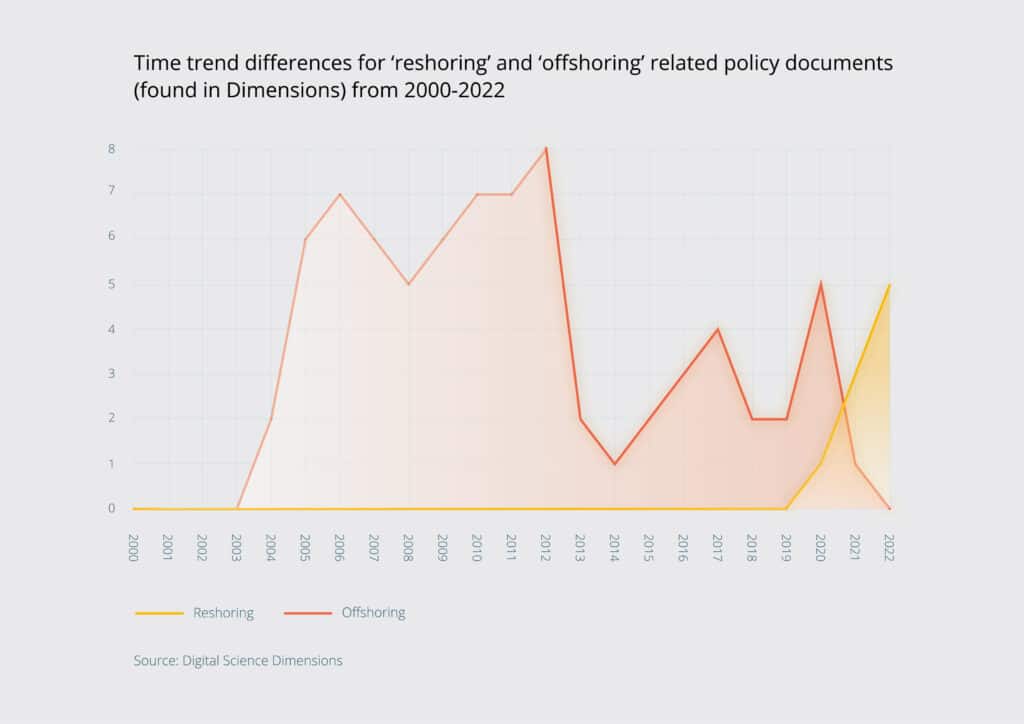

Figure 1 demonstrates that in the last 10 years the trend in research associated with reshoring has been mostly upward, whereas for research associated with offshoring there is evidence that research associated with offshoring is marked by a sizable downturn from 2012 and has not recovered.

| ‘Reshoring’ (keyword) | ‘Offshoring’ (keyword) | |||

| Across all years: | Publications | Policy docs | Publications | Policy docs |

| 481 | 9 | 3,431 | 75 | |

Figure 1 below outlines trends over time and where we see that offshoring, depicted by the darker blue line, peaks in 2012 and then declines rapidly, and does not recover in terms of numbers of published papers. For ‘reshoring’ we see the opposite trend – virtually no research published until 2012 followed by a continuous upward trend. These observations are in line with what we might see as a paradigm shift in manufacturing from global to fragmented.

Similarly, depicted below, we find equivalent trends for policy documents (albeit with smaller numbers – see Figure 2) – policy documents associated with ‘reshoring’ not starting to be documented until 2019 and continuing to rise, whereas for policy documents related to ‘offshoring’ the trend started much earlier, in 2014, showing a much more checkered increase until 2013 where we see it decreasing, and dwindling to zero in 2022.

“…decisions to reshore are becoming increasingly popular in both Europe and the US, with businesses reversing prior decisions to offshore.”

Conclusion

We can make a number of conjectures from this simple analysis. First, that there is indeed a shift from globalization towards fragmentation from the perspective of what are known as ‘value chain activities’, particularly production in manufacturing.[8]

Second, although, as the WTO chief states, we are not yet seeing large-scale fragmentation, the signs are there and decisions to reshore are becoming increasingly popular in both Europe and the US, with businesses reversing prior decisions to offshore.[9]

A further point – following the simple analysis carried out in this piece – is that research publications outlined related to offshoring start to increase rapidly from 2003, whereas for the research relating to ‘reshoring’ the research does not start to increase until ten years later in 2013. This bolsters the empirical evidence that globalization (offshoring, or moving production to foreign locations) is perhaps giving way to fragmentation (reshoring, or localization of production closer to home).

References

[1] https://www.tandfonline.com/doi/full/10.1080/21681376.2023.2199054

[2] https://www.sciencedirect.com/science/article/pii/S0148296323003636?ref=pdf_download&fr=RR-2&rr=81703bfd584f4887#b0810

[3] https://www.xometry.com/resources/procurement/what-is-reshoring/

[5] https://www.xometry.com/resources/procurement/what-is-reshoring/

[6] https://www.dudleyindustries.com/news/benefits-of-reshoring-manufacturing-to-the-uk

[7] https://www.europarl.europa.eu/RegData/etudes/STUD/2021/653626/EXPO_STU(2021)653626_EN.pdf

[8] https://www.sciencedirect.com/science/article/pii/S0148296323003636?ref=pdf_download&fr=RR-2&rr=81703bfd584f4887#b0810