Perspectives on funding and collaboration, and the localisation of SDGs in the pharmaceutical industry

“Nearly two billion people globally still lack access to essential medicines and vaccines that could prevent and treat diseases, relieve suffering, improve quality of life and prevent deaths”.

GlaxoSmithKline.[1]

Summary

In this blog we present findings from a bibliometric evaluation of scientific publications that include a contribution from the top ten pharmaceutical companies in the Global North and Global South, which have been indexed in Digital Science’s Dimensions database in the past five years (2018 to 2022). The study maps aspects of the landscape in this area exploring differences in pharmaceutical research practices from different perspectives including funding and collaboration, pharmaceutical research and its association with the SDGs, the impact of the cost of medicines developed by pharma and their accessibility in distinct geographic regions. The results show significant gaps between the two global areas, but also some ways where these gaps are now closing.

Contents

Introduction

Access to essential medicines is a serious global concern, regardless of the income level of a country. Medicines are not affordable for those who need them in many low- and middle-income countries (the Global South), and many new medicines are too expensive even for the health systems of middle- and high-income countries (the Global North)[2].

“An estimated two billion people worldwide still lack access to essential medicines and vaccines.”

World Health Organization (WHO) report.[3]

Staggeringly, an estimated two billion people worldwide still lack access to essential medicines and vaccines that could prevent and treat diseases, relieve suffering, improve quality of life and reduce deaths,[3] and the majority of these people are living in global south countries. This is a clear example of fragmentation in our society – a disconnect between the ‘haves’ and ‘have nots’, where science and medicine could save lives but are unable to overcome the barriers in their way.

Pharmaceutical companies are recognised as being uniquely positioned to remedy this and improve people’s lives by producing innovative and affordable medicines[4]. However, their products have generally been developed to target more lucrative markets and, as a result, are often poorly matched with the needs of global south countries.

“Achieving equitable access to medicines is a key component in the UN’s Sustainable Development Agenda.”

Dr Briony Fane, Digital Science

Achieving equitable access to medicines is a key component in the UN’s Sustainable Development Agenda. In particular, one of the targets of the UN’s Sustainable Development Goal 3 (SDG3) – ‘Good Health and wellbeing’ – is to achieve Universal Health Coverage (UHC) and is a critical driver to realising health equity. Equitable access and resilient health systems are the basis for UHC, by enabling availability, affordability, and acceptability to ensure that people can get the right medicines of the right quality at the right price and at the right place[5].

Since 2006 the UN’s Industrial Development Organization (UNIDO) has provided support and assistance to advance local pharmaceutical production in developing countries where its support contributes effectively to strengthening the health security of the global south countries and as a follow on to attaining SDG3, addressing the need for “access to safe, effective, quality, and affordable essential medicines and vaccines for all”[6]. However, there remain barriers for many people in the world who have difficulty accessing the healthcare they need for multiple reasons, including:

“While countries in the Global South have obtained benefits from pharmaceuticals originally developed for high income country markets, little research has been conducted on diseases that primarily affect these countries, such as malaria or tuberculosis.”

From “Access to Essential Drugs in Poor Countries: A Lost Battle?”[8]

Even for diseases that affect both the Global North and the Global South alike, research often focuses on products that are best suited for use in the Global North. For example, a lot of pharmaceutical research has been conducted on complex AIDS drugs that are more useful in global north countries, but too expensive and difficult to deliver to much of the population in global south countries.[9] The lower income countries take the bulk of the global disease burden, yet essential healthcare products are often unaffordable or unavailable to them.

Achieving greater access for the global south countries who have less access to the most essential of medicines requires pharmaceutical companies to give them a place in their business operations. The 2022 ‘Access to Medicine Index’[10] evaluates and compares 20 of the world’s leading research-based pharmaceutical companies according to their efforts to improve access to medicine. Data analysed for the 2022 Index found that more companies had stepped up their access efforts – including some companies that were previously less likely to take action.[11] The data relates to 83 diseases, conditions and pathogens that disproportionately impact people living in the 108 global south countries in scope of the Index, where better access to medicine is most urgently needed. Most recently, Johnston & Johnston has agreed to allow generic versions of the drug bedaquiline in dozens (96) of lower income countries to be made available. It is implementing this by providing the Global Drug Facility (GDF)[12] with licences enabling the organisation to procure and supply generic forms of the drug countries the organisation supplies.[13]

The ability to contribute to health equity and, more specifically, facilitate access-to-medicine, has increasingly become a priority for the pharmaceutical industry. However, while steps are being taken to improve access to their products in the global south, many plans and strategies still overlook the poorest countries.

The new geography of the pharmaceutical industry

“The geographic concentration of the pharmaceutical industry currently sits in those countries with the fastest growing economies.”

Dr Briony Fane, Digital Science

The geographic concentration of the pharmaceutical industry currently sits in those countries with the fastest growing economies. This concentration is gradually starting to shift and more and more we are seeing that pharmaceutical production in developing countries is increasing. For instance, India is now a more prominent and developing player in the global pharmaceutical industry and their domestic pharmaceutical market’s growth outpaced that of the overall economy by 2-3% a year[14]. According to China Briefing, the Chinese pharmaceutical market has grown in the past few years, with a 200% increase in market capitalisation between 2016 and 2020.[15] Thus, although the US pharmaceutical industry still dominates the global market, accounting for roughly 50% of global pharmaceutical sales revenue, we are seeing shifting patterns in the geography of the pharmaceutical industry.

The research-based pharmaceutical industry is also entering a new era in medicines development[16] and there is fast growth in the market and research environment in emerging economies such as Brazil, China and India, leading to a gradual migration of economic and research activities from Europe to these markets[17]. That said, of the 40 vaccine manufacturers in 14 nations that are part of The Developing Countries Vaccine Manufacturers Network, currently just one is African: the Biovac Institute based in Cape Town, South Africa, which delivers over 25 million doses of vaccines each year for illnesses such as measles, polio and tuberculosis.[18]

Consequently there is still a heavy reliance on external sources and the export of medicines to African nations. However, within the next two decades, the African Union member states are aiming for 60% of Africa’s routinely used vaccines to be manufactured on the continent.[19] With roughly half the population of Africa lacking regular access to the most essential medicines, according to the WHO,[20] attempts to reduce this has seen a growing number of healthcare practitioners beginning to build the pharmaceutical manufacturing capacity on the African continent.

Crossing the continents, Bangladesh’s pharmaceutical industry is unique in the Global South. Driven by active government policies, output has grown a thousand times since 1982, to US$2 billion (around 1% of gross domestic product), making it the biggest white collar employer in the country. The industry supplies pharmaceuticals to almost the entire domestic market and more than 100 other countries including the United States.[21]

The pharmaceutical industry’s commitment to the Sustainable Development Goals (SDGs)

The value of translating scientific evidence into action in support of the SDGs and their attainment is of paramount importance. The pharmaceutical industry’s participation in accelerating achievement of the SDGs requires that its roadmap for research and development includes demonstrating its ability to tackle diseases in both global south and global north countries.

The need to have access to safe and effective essential medicines is so important that it has been designated a basic human right by the World Health Organization.[22] This importance has been given further weight by its inclusion in the UN’s Sustainable Development Agenda.

Access to medicine is essential for ending epidemics and reducing the mortality in non-communicable diseases and is one of the targets of Sustainable Development Goal 3 – Good Health and well-being (SDG3.4). Of course, living healthy lives is what most people would expect, or at the very least hope for, in the 21st century. However, for millions, this remains an aspiration. The mission of SDG3 is to change this and ensure healthy lives and promote well-being for people of all ages, and the pharmaceutical industry is making inroads in its contribution to SDG3 and beyond.

For example, GlaxoSmithKline (GSK) expresses a long-term commitment to improving access to health care across the world. Since 2010, it has capped the prices of patented medicines and vaccines in the “least developed countries” at 25% of those in the EU5 (France, Germany, Italy, Spain, and the UK) as long as manufacturing costs are covered[23].

We also examine how the UN SDGs influence the pharmaceutical industry to do more good than changing and saving lives. So although the pharmaceutical industry’s primary impact is in SDG3, other Goals such as SDG12 Responsible Consumption and Production and SDG6 Clean Water and Sanitation are also influential.

“A number of leading pharmaceutical companies now demonstrate ‘responsible production’ by, for example, reducing animal testing and hazardous chemical use (Bayer), recycling water in the manufacturing process (GSK), or education on vaccination for the community (Pfizer)…”

Dr Briony Fane, Digital Science

For example, a number of leading pharmaceutical companies now demonstrate ‘responsible production’ by, for example, reducing animal testing and hazardous chemical use (Bayer), recycling water in the manufacturing process (GSK), or education on vaccination for the community (Pfizer), along with wastewater management, water recycling, and the use of green chemistry aimed to address environmental issues. The above examples focus on targets set out in SDG12 and SDG6.

Methodology

We extracted the top ten pharmaceutical companies by income using GRID IDs (parent GRID), whilst extracting the (child GRID) ID for each company (the top pharmaceutical companies operate worldwide and have subsidiaries across the globe) and this allowed us to split them into those operating in global north countries and those operating in global south countries depending on operation bases, ie, where top ten pharmaceutical companies based in the Global North have operations carrying out pharmaceutical research and development in the Global South. Dimensions allows us to do this using Google Big Query (GBQ) bringing together World Bank data for the Global North and Global South distinction, and the research output from Dimensions, to perform the analyses.

Next, a simple boolean search string was created: “access medicine”~3 and, along with our search string of top ten pharmaceutical companies, Dimensions retrieved the relevant research outputs for pharmaceutical companies in global north and in global south countries.

Using the set of search results we filtered the research output by Global South (low and lower-middle income countries) and Global North (high and upper-middle income countries).

Analysis

Global North and Global South

In this section we analysed the relevant research that involves the top ten pharmaceutical companies and their contribution to research on ‘access to medicine’ in the Global North and in the Global South.

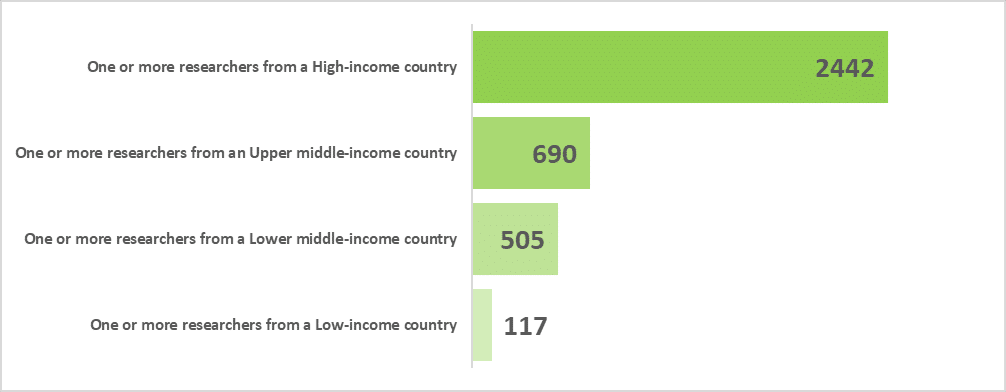

To get an initial sense of the data, we first analysed ‘access to medicine’ research publications featuring top ten pharmaceutical companies, using Dimensions. This enabled us to ascertain the geographical distribution of the pharmaceutical companies’ participation in this domain (see Figure 1) in global north and global south countries.

Figure 1 details the total volume of research publications associated with ‘access to medicine’ research by country income level.. Of the total volume (3,165 publications), 109 (3.4%) include a contribution from the pharmaceutical industry. 1,473 publications from the dataset did not have the required data to determine country-income group (46%).

Pharmaceutical funding and collaboration with ‘access to medicine’ research publications

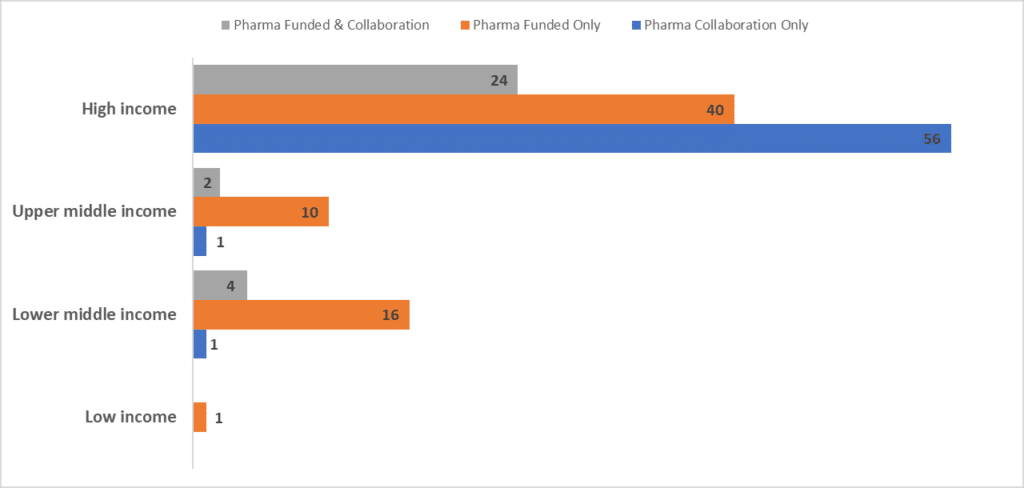

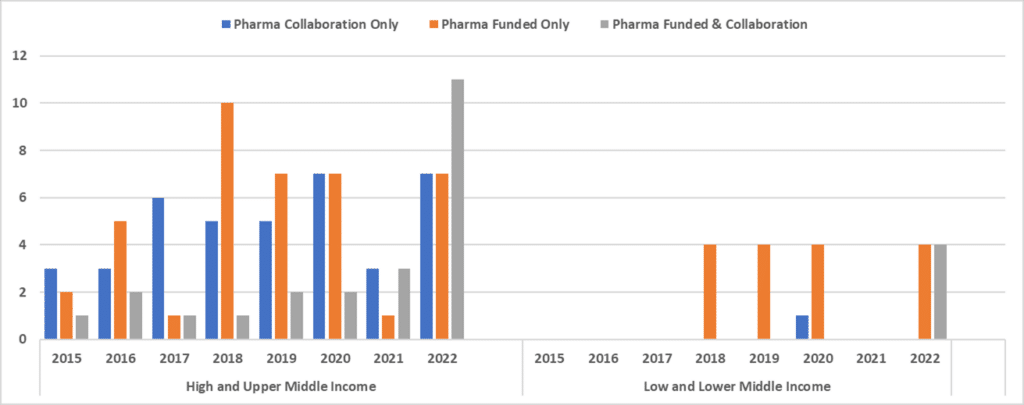

Figure 2 outlines the volume of papers across global north and global south countries over time. We note that a mixed pattern emerges. We also note that numbers are small and might expect this for two reasons. Firstly, access to medicine research is a particularly niche area of research, and secondly, historically, it has not been common for the pharmaceutical industry to collaborate on academic research. But this is changing with links between academia and the pharmaceutical industry increasing both as funding partners or as collaborators, or both.[24] The data here would confirm this. What is apparent is that pharmaceutical companies predominantly collaborate with researchers and fund more research in the high income countries of the Global North. Although there is evidence of pharmaceutical companies funding and collaborating with research in the global south, it is to a much lesser extent. Figure 3 reveals that collaboration in conjunction with funding by pharma for research associated with ‘access to medicine’ is evident in 2022 for the first time. It would be interesting to see whether this is the starting point for the pharmaceutical industry’s engagement and collaboration with academic researchers in the Global South going forward.

The top ten pharmaceutical industry’s contribution to ‘access to medicine’ relevant research in Global North and Global South countries is displayed in Figure 3 above detailing the extent to which collaboration and funding in this area is focused in the two regions over an eight year period. Immediately apparent is the stronger commitment to the higher income countries, where, in particular, the pharmaceutical industry’s collaborations with academic research is most pronounced. Funding and/or collaborating with research in the Global South shows data only across three years.

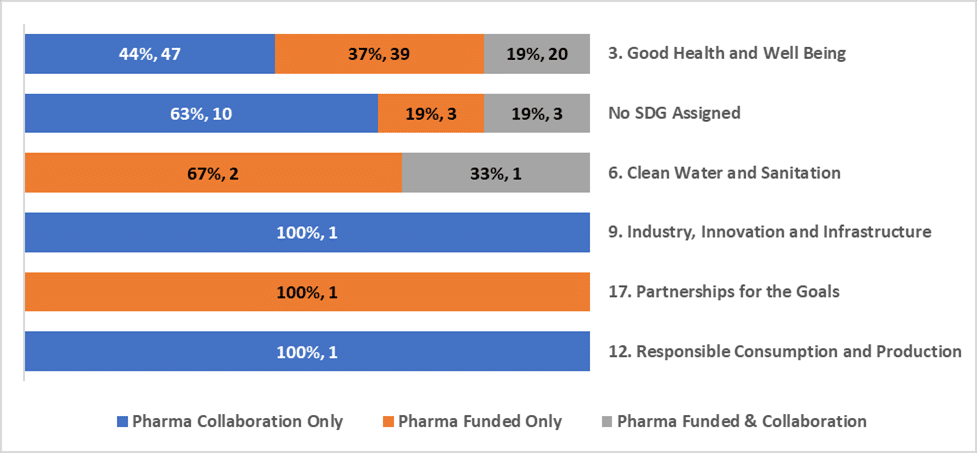

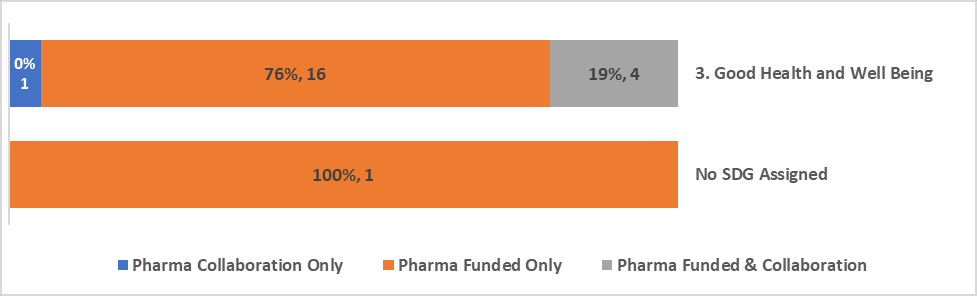

Pharma funding and collaboration associated with the UN Sustainable Development Goals

Figures 4a and 4b above assess the volume of research outputs that are associated with the UN’s SDGs, either funded or in collaboration with, or both, the pharmaceutical industry. Unsurprisingly, the research focus is predominantly with SDG3 – Good health and well-being, however the data would suggest that there are potentially starting to be signs of their focus extending to SDG12 Responsible Production and Consumption (eg, supply chains) and SDG6 Clean Water and Sanitation (eg, management of wastewater). With reference to SDG6, advances in wastewater treatment processes are being made in the industry to prevent the discharge of harmful substances into water resources and the environment. In fact AstraZeneca has made an 18.7% reduction in water use since 2015 and 100% reduction of active pharmaceutical ingredients discharges from AstraZeneca sites. 92% of discharges from direct suppliers were in compliance with SDG6 target 6.3.[25] With respect to SDG12 again, AstraZeneca averted 2,129 tonnes of waste in 2022 alone by selling it as a by-product.

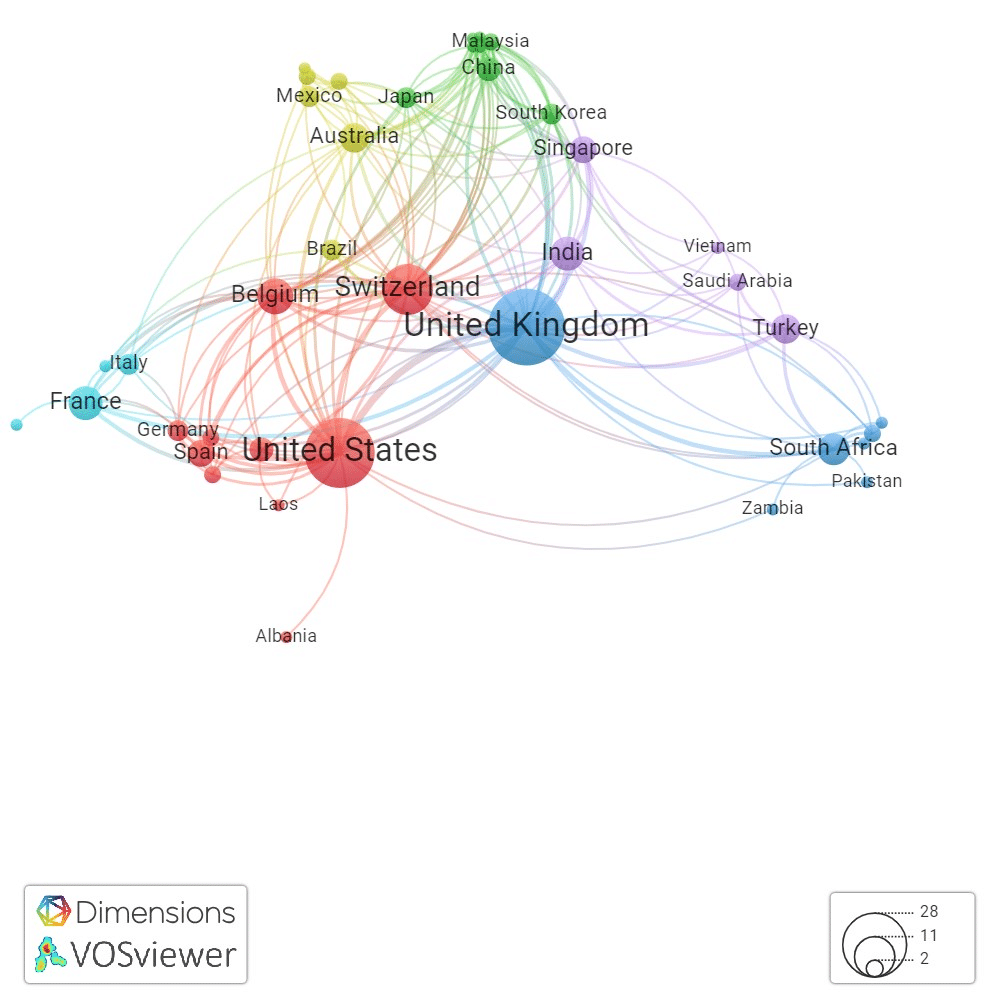

The geographical distribution of the top ten pharmaceutical industry’s participation in research associated with ‘access to medicine’ research was examined using a collaborative network visualisation tool (see Figure 5 above), VOSviewer. The tool allows us to see, in this instance, countries participating in research focused on ‘access to medicine’, the collaborative networks between those countries, and where pharmaceutical companies concentrate their collaborations. Understanding geographic patterns can also help to identify potential gaps and highlight areas where more collaborative effort might be valuable. It can also indicate regions where the pharmaceutical industry is more proactive in supporting research on access to medicines.

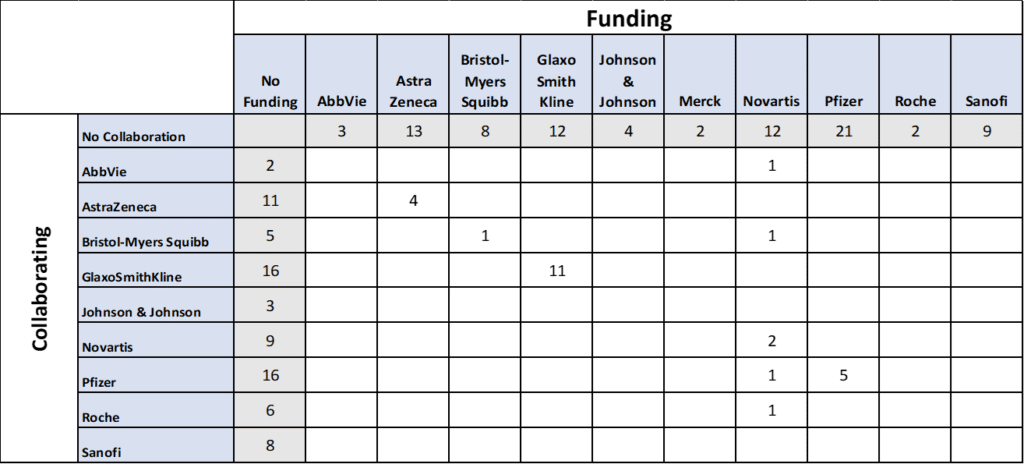

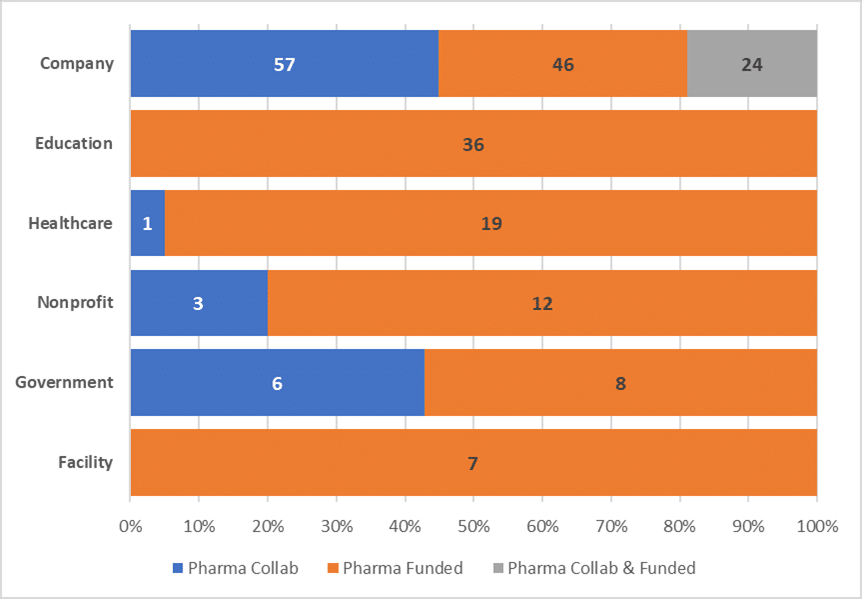

Funding Sources-Pharmaceutical Partnerships

We present data in Figure 6 to provide an understanding of the financial and/or collaborative support from the pharmaceutical industry behind research focused on ‘access to medicine’ in different sectors. Analysis of the dataset using Dimensions, allowed us to determine the proportion of research funded by pharmaceutical companies, alongside other sources, including government agencies, foundations, and nonprofit organisations. The analysis provides an indication (despite small numbers[26]) of the extent of the pharmaceutical industry’s financial commitment to ‘access to medicine’ research in the Global North and Global South, and helps to evaluate the diversity of pharmaceutical funding of research in this area.

Conclusion

Exploring a niche area of research as we have done here with our focus on ‘access to medicine’, means that the data retrieved will be small in number, and made smaller by the introduction of a filter which is possible using Dimensions which in this case is the top ten pharmaceutical companies. Lower numbers in an analysis naturally brings with it a number of caveats, and one in particular, the robustness of the data and subsequent outcomes.

Despite this, it is still worthwhile and beneficial to explore the research from this perspective and has provided some useful insights. Insights such as the industries that the pharmaceutical industry supports in this niche area and where we see that it is not just in healthcare but also in education, government, not for profits, etc that science is funded for the development of new pharmaceutical products aimed at transforming lives.

“…it is not just in healthcare but also in education, government, not for profits, etc that science is funded for the development of new pharmaceutical products aimed at transforming lives.”

Dr Briony Fane, Digital Science

Further, the geography of the pharmaceutical industry’s participation in this area of research indicates perhaps the start of a growing commitment to its involvement in addressing the access to medicine in all areas in the world and evidence of collaboration across the Global North and Global South, however small, shows a level of responsibility being taken by the industry.

Finally, on a general note, a survey by the Association of the British Pharmaceutical Industry in 2022 found that ‘industry-academic links were at an all time high and identified several trends pointing to the continued support of the pharmaceutical industry for students training and research all across the UK and worldwide’.[27]

“The geography of the pharmaceutical industry’s participation in this area of research indicates perhaps the start of a growing commitment to its involvement in addressing the access to medicine in all areas in the world and evidence of collaboration across the Global North and Global South, however small, shows a level of responsibility being taken by the industry.”

Dr Briony Fane, Digital Science

References

[1] https://www.gsk.com/en-gb/responsibility/global-health-and-health-security/improving-access-to-healthcare/

[2] Wirtz VJ, Hogerzeil HV, Gray AL, Bigdeli M, de Joncheere CP, Ewen MA et al. Essential medicines for universal health coverage. Lancet. 2017;389(10067):403–76

[3] https://cdn.who.int/media/docs/default-source/essential-medicines/fair-price/chapter-medicines.pdf?sfvrsn=adcffc8f_4&download=true

[4] https://unglobalcompact.org/library/1011

[5] https://www.gsk.com/en-gb/responsibility/global-health-and-health-security/improving-access-to-healthcare/

[6] https://www.unido.org/our-focus-advancing-economic-competitiveness-investing-technology-and-innovation-competitiveness-business-environment-and-upgrading/pharmaceutical-production-developing-countries

[7] https://www.astellas.com/en/sustainability/access-to-medicines

[8] Pecoul, Bernard et al. 1999. “Access to Essential Drugs in Poor Countries: A Lost Battle?” Journal of the American Medical Association. January 27, 281:4, pp. 361–67

[9] http://www2.hawaii.edu/~noy/362texts/pharma.pdf

[10] https://accesstomedicinefoundation.org/medialibrary/2022_access-to-medicine-index-1669982470.pdf

[11] https://accesstomedicinefoundation.org/medialibrary/2022_access-to-medicine-index-1669982470.pdf

[12] https://www.stoptb.org/facilitate-access-to-tb-drugs-diagnostics/global-drug-facility-gdf

[13] https://www.science.org/content/article/major-drug-company-bends-battle-over-access-key-tb-treatment?utm_source=Nature+Briefing%3A+Translational+Research&utm_campaign=89b7cf8e10-briefing-tr-20230726&utm_medium=email&utm_term=0_872afe2a9a-89b7cf8e10-47896968

[14] https://www.wilsoncenter.org/blog-post/indias-economic-ambitions-pharmaceutical-industry

[15] https://www.china-briefing.com/news/china-booming-biopharmaceuticals-market-innovation-investment-opportunities/

[16] https://www.efpia.eu/media/637143/the-pharmaceutical-industry-in-figures-2022.pdf

[17] https://aijourn.com/press_release/pharmaceutical-glass-packaging-global-market-report-2023-growth-of-pharmaceutical-industry-in-emerging-economies-drives-sector-researchandmarkets-com/

[18] https://unctad.org/news/covid-19-heightens-need-pharmaceutical-production-poor-countries

[19] Saied, AbdulRahman A.a,b,*. Africa is going to develop their own health capabilities for future challenges – Correspondence. International Journal of Surgery 99():p 106585, March 2022. | DOI: 10.1016/j.ijsu.2022.106585

[20] https://www.who.int/news/item/13-12-2017-world-bank-and-who-half-the-world-lacks-access-to-essential-health-services-100-million-still-pushed-into-extreme-poverty-because-of-health-expenses

[21] https://www.un.org/ldcportal/content/what-ldc-graduation-will-mean-bangladesh%E2%80%99s-drugs-industry

[22] https://apps.who.int/iris/bitstream/handle/10665/255355/9789241512442-eng.pdf

[23] https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6316355/

[24] https://www.abpi.org.uk/media/news/2022/september/new-survey-shows-collaboration-between-pharmaceutical-industry-and-uk-academia-is-growing/#:~:text=This%20year’s%20survey%20shows%20that,3%2Dfold%20increase%20since%202015.

[25] https://www.astrazeneca.com/content/dam/az/Sustainability/2023/pdf/Sustainability_Report_2022.pdf

[26] The small numbers in part might be the result of the pharmaceutical industry being less eager to publish their funded research in this area, though the topic of the search for “access to medicine’ is less ‘confidential’ in comparison to research published on a potentially new pharmaceutical ingredients etc.

[27] https://www.abpi.org.uk/facts-figures-and-industry-data/industry-and-academia-links-survey-2022/